Health Equity/Social Determinants of Health

Health Equity/Social Determinants of Health 3

553 - The Child Tax Credit Helped With Health Expenses, Improved Wellness - But Missed Some Families

Publication Number: 553.118

Bonnie E. Hawkins, MD (she/her/hers)

Pediatric Resident, PGY3

Children's National Health System, District of Columbia, United States

Presenting Author(s)

Background:

Child tax credits can improve pediatric health. Proposed mechanisms include increased access to medical care, increased preventative health-related spending, and alleviation of chronic stressors. From July 2021 to December 2021, the child tax credit (CTC) amount was increased, half was paid monthly, and families with low incomes were newly eligible.

Objective:

This survey-based pilot study investigated how the expanded CTC could support pediatric health for children who may have increased health needs.

Design/Methods:

Families were recruited by going room-to-room on inpatient pediatric hospital floors at a large, academic, urban hospital, except rooms with special precautions or signs with specific entry requirements. Inclusion criteria were: 18 or older, parent or legal guardian of an admitted patient under 18, and English- or Spanish-speaking. Participants scanned a QR code to access the study. Some were not able to participate due to lack of technology. Approximately 50% of families scanned the code. Survey questions focused on preventative health spending such as improved nutrition, direct health spending such as co-pays, and wellness including stress.

Results:

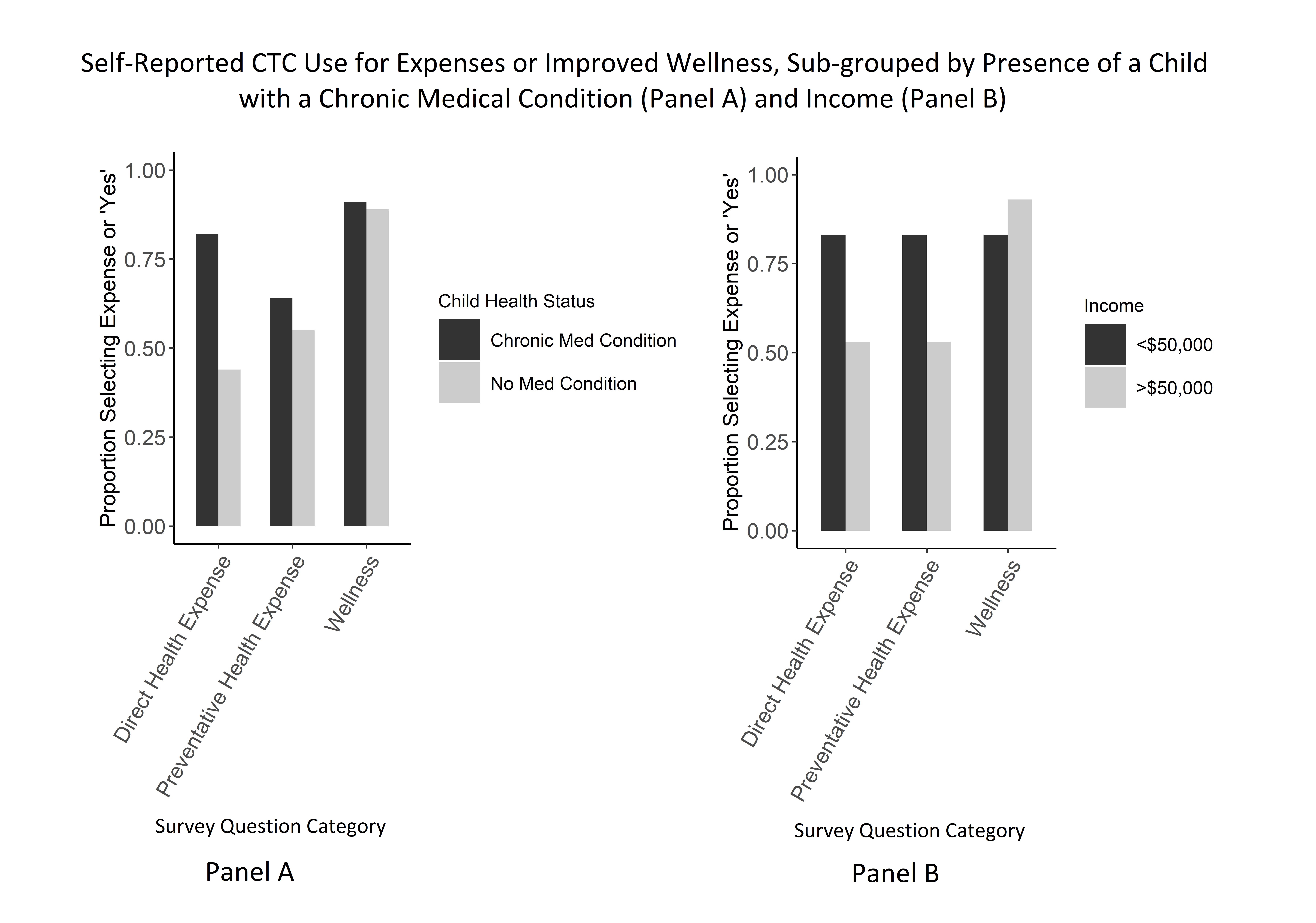

Forty-three participants were recruited. Figure 1 displays participant family child ages and figure 2 displays income distribution. Twenty participants reported having a child with a chronic medical condition. Only 49% of all families reported getting the tax credit. Thirty percent with incomes < $150,000 reported not getting the tax credit and 16% weren’t sure. For families who received the tax credit, 100% reported using the extra funds for a direct health expense, preventative health expense, and/or reported improved wellness. Of those who got the tax credit, responses were sub-grouped by income level (above or below $50,000) and presence of a child with a chronic medical condition (figure 3). An income level of $50,000 is above the federal poverty level except for very large families. Differences were not statistically significant: a majority or near-majority (44%) of each sub-group reported an expense or improved wellness.

Conclusion(s):

In conclusion, this study suggests the CTC supported pediatric health expenses and family wellness. The expanded CTC expired in 2021. Re-instating it might help families afford health expenses for their children. Further study of objective health measures is needed. Additionally, if reinstated, outreach will be critical to ensure all eligible families receive it.

This research was partially funded by the Building Equity in GME Resident Health Equity Research Award supported by the Children's National Rozanski Training Fund.

Figure_One_PAS_BH_CTC (1).jpeg

Figure_Two_PAS_BH_CTC (1).jpeg